Table of Contents

Introduction

Family offices in the United States are rapidly growing and overseeing assets valued at trillions of dollars. They put long-term goals ahead of short-term profits, in contrast to traditional investment firms.

Private businesses called family offices were established to oversee the wealth of affluent families. They help families protect and grow their wealth over generations by handling investments, financial planning, and long-term wealth management.

Family offices are growing more significant in the U.S. economy as their financial power increases. This rising influence is redefining how wealth is managed, invested, and preserved across generations.

What Is a Family Office?

A family office is a private company created to handle the financial matters of a rich family. Its primary aim is to safeguard, increase, and manage wealth in a structured and long-term manner.

- Investment Management: Family offices allocate funds across various assets like stocks, private businesses, and real estate. These investments are selected with care to promote long-term growth instead of quick gains.

- Wealth Planning: They assist families in planning for the future by overseeing savings, taxes, and inheritance. This guarantees that wealth is transferred smoothly from one generation to another.

- Risk Management: Family offices strive to minimize financial risks by diversifying investments and preparing for market fluctuations. This helps to shield family wealth during economic downturns.

- Personalised Services: In contrast to traditional firms, family offices provide tailored financial solutions. Each decision is customized to meet the unique needs and objectives of the family.

Why Family Offices Are Growing in the U.S.

Family offices are becoming increasingly popular in the United States because of growing wealth and evolving investment requirements.

- Wealth Growth: The number of wealthy individuals in the U.S. has risen over time. As their wealth increases, families require specialized teams to handle extensive and intricate financial portfolios.

- Need for Control: Family offices enable families to make their own investment choices. This provides them with greater flexibility and authority compared to conventional investment firms.

- Long-Term Objectives: In contrast to many financial institutions, family offices focus on preserving wealth over the long term. This strategy allows families to plan for future generations rather than just seeking immediate profits.

- Confidentiality and Personalization: Family offices provide a significant degree of privacy and customized services. Families favor this approach as it ensures their financial affairs remain private and are adapted to their unique requirements.

How Family Offices Manage Wealth

Family offices take a systematic approach to managing and improving family wealth. They prioritize long-term stability, thorough planning, and wise investment decisions.

- Diverse Investments: Family offices allocate funds across various asset classes. This includes stocks, private companies, real estate, and alternative investments to minimize risk.

- Expert Advisors: They collaborate with financial specialists, legal consultants, and tax experts. This guarantees well-informed choices and proper management of intricate financial issues.

- Tax Strategies: Smart tax planning is implemented to lower unnecessary expenses. Family offices structure investments to enhance tax efficiency over time.

- Ongoing Review: Investments are assessed regularly to align with financial objectives. This allows for strategy adjustments based on market fluctuations and family needs.

Investment Strategies Used by Family Offices

Family offices adopt flexible investment strategies aimed at long-term objectives. Their method emphasizes consistent growth, risk management, and value generation over time.

- Private Equity: Family offices put money into private firms that are not traded on stock markets. These investments can yield higher growth but demand patience and a long-term focus.

- Real Estate: Numerous family offices allocate funds to both residential and commercial properties. Real estate offers reliable income and appreciates over the long haul.

- Public Markets: They also invest in stocks and bonds to ensure liquidity. These investments assist in balancing risk while providing easier access to funds when necessary.

- Alternative Assets: Family offices investigate assets such as hedge funds, commodities, and venture capital. These choices aid in diversifying portfolios and lessen reliance on conventional markets.

Impact of Family Offices on the U.S. Economy

Family offices significantly impact the U.S. economy through their investment choices. Their increasing financial strength affects businesses, markets, and overall economic growth.

- Support for Businesses: Family offices provide funding to both startups and established firms. This investment enables businesses to grow, innovate, and generate new employment opportunities.

- Growth of Private Markets: A number of family offices favor private investments instead of public ones. This trend has expanded the role of private equity and private credit in the U.S. economy.

- Stability During Market Changes: Family offices tend to focus on long-term objectives, allowing them to invest consistently even during market declines. This approach can help mitigate volatility and promote economic stability.

- Capital Flow Influence: Major investment choices made by family offices determine the direction of capital in the economy. Their decisions can influence trends in various sectors, including technology, real estate, and healthcare.

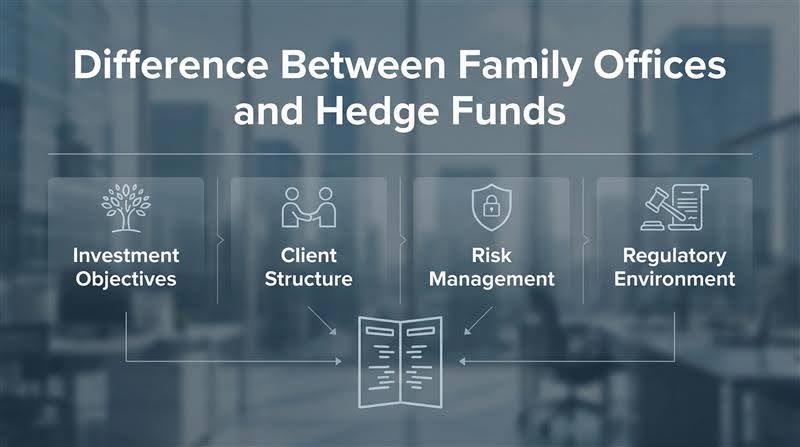

Difference Between Family Offices and Hedge Funds

Family offices and hedge funds both handle significant sums of money, but their objectives and methods differ greatly.

- Investment Objectives: Family offices prioritize long-term wealth preservation and growth. In contrast, hedge funds typically seek short-term gains and market performance.

- Client Structure: A family office caters to one family or a small group of related families. Hedge funds, on the other hand, manage funds for various external investors.

- Risk Management: Family offices usually adopt a cautious and balanced approach to risk. Hedge funds frequently employ aggressive tactics to enhance returns.

- Regulatory Environment: Hedge funds are subject to more regulations and must adhere to strict reporting standards. Family offices encounter fewer regulatory obligations due to their private nature.

Recognizing these distinctions clarifies the rising popularity of family offices.

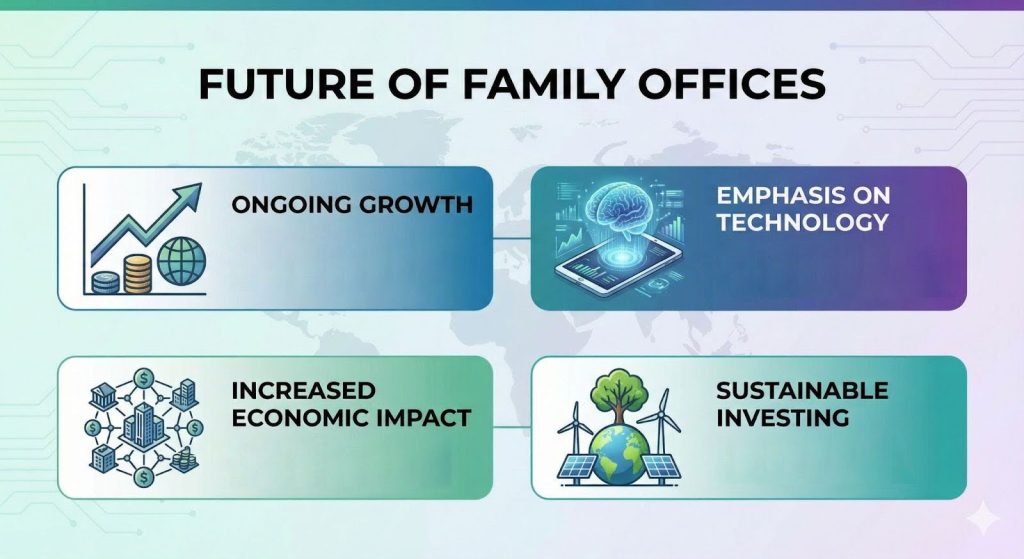

Future of Family Offices

Family offices are anticipated to have a larger role in the U.S. financial system in the years ahead.

- Ongoing Growth: The number of family offices is projected to rise consistently. Increasing wealth and the demand for tailored financial planning will fuel this expansion.

- Increased Economic Impact: Family offices will exert a greater influence on private markets and business financing. Their investment choices will continue to shape industries and economic patterns.

- Emphasis on Technology: A growing number of family offices are utilizing advanced financial technology. Tools such as data analytics and digital platforms will enhance decision-making and operational efficiency.

- Sustainable Investing: Numerous family offices are expressing interest in sustainable and impact investing. This trend indicates a heightened emphasis on social responsibility and the creation of long-term value.

As wealth increases, more families are expected to embrace this private wealth management approach.

Conclusion

Family offices have become a significant element of the U.S. financial scene. What began as a private method for managing family wealth has evolved into a strong system that impacts investments, businesses, and markets nationwide.

By concentrating on long-term strategies, adaptability, and tailored approaches, family offices provide an alternative to conventional investment firms. Their capacity to invest patiently and discreetly enables them to foster economic growth while safeguarding wealth for future generations.

As their influence continues to grow, family offices are expected to further shape the future of the U.S. economy. Recognizing their role clarifies how private wealth is subtly driving substantial financial and economic transformations.

Deepak Wadhwani has over 20 years experience in software/wireless technologies. He has worked with Fortune 500 companies including Intuit, ESRI, Qualcomm, Sprint, Verizon, Vodafone, Nortel, Microsoft and Oracle in over 60 countries. Deepak has worked on Internet marketing projects in San Diego, Los Angeles, Orange Country, Denver, Nashville, Kansas City, New York, San Francisco and Huntsville. Deepak has been a founder of technology Startups for one of the first Cityguides, yellow pages online and web based enterprise solutions. He is an internet marketing and technology expert & co-founder for a San Diego Internet marketing company.